Early Fraud Detection with Slack Notifications

Because of the schedule established by the business, payouts run automatically twice a week. This has been the pattern for quite a while, and although we have proposed extending the time for payouts to prevent fraud, it is not yet a priority.

Sometimes we receive reports about suspicious activities regarding our customers, and usually after investigation, I was able to uncover fraudulent activities. It is really cool to uncover a scam operation. What they usually do is use stolen cards and execute payments involving their account. The problem comes when the card owner raises a dispute; the order in these cases is clear: refund the money.

The business has been managing this in the same way ever since I remember, and what I find most annoying is that the money is lost twice. This is because usually the money is already paid to our customer (scammer in this case) due to the short evaluation period for payments, and we have to refund the money to the cardholder.

The number of these situations is kind of low in comparison with all of the payments we receive, but there have been several cases in which the total amount refunded is over $10,000. I guess you agree with me that losing such an amount is not funny.

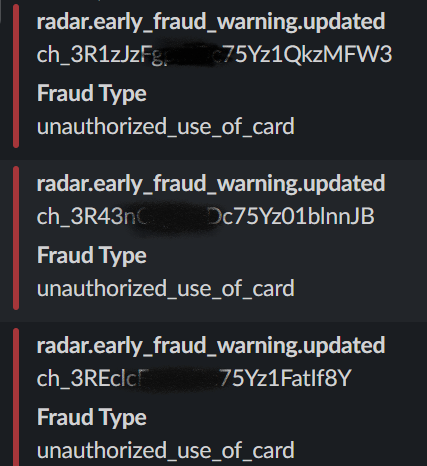

I figured out that Stripe can send early fraud detection events, and as we were already using Stripe webhooks to process payments, it was really easy to set up a validation for these types of events and also send the information related to the person in charge using a Slack notification.

These types of situations are still happening, and until it becomes a priority for the business, the best I can do is let them know that something fishy is happening and require their attention.

Get quality content updates subscribing to the newsletter, Zero Spam!